Thursday 26 September 2024

ISTAT EMEA: 2024 – a bumper year for aircraft ABS?

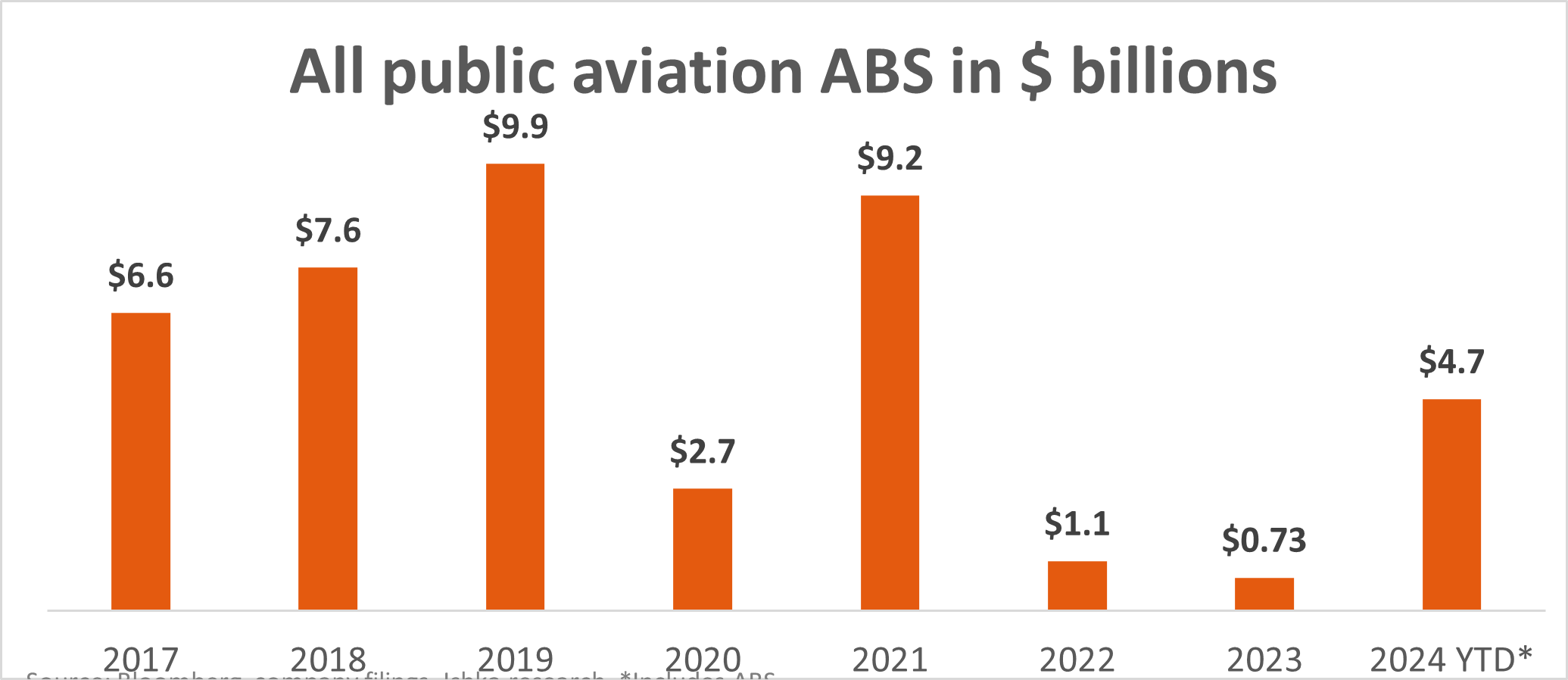

Sources confirm more aircraft ABS are in the works, with one panellist at ISTAT predicting 2024 could end up being a bumper year for aircraft ABS. Several sources confirmed that at least two more aircraft lease securitisations are expected to price before November this year with others suggesting that there could even be as many as three additional aircraft ABS deals before year-end. Other sources are more sceptical and suggest some deals could surface in 2025.

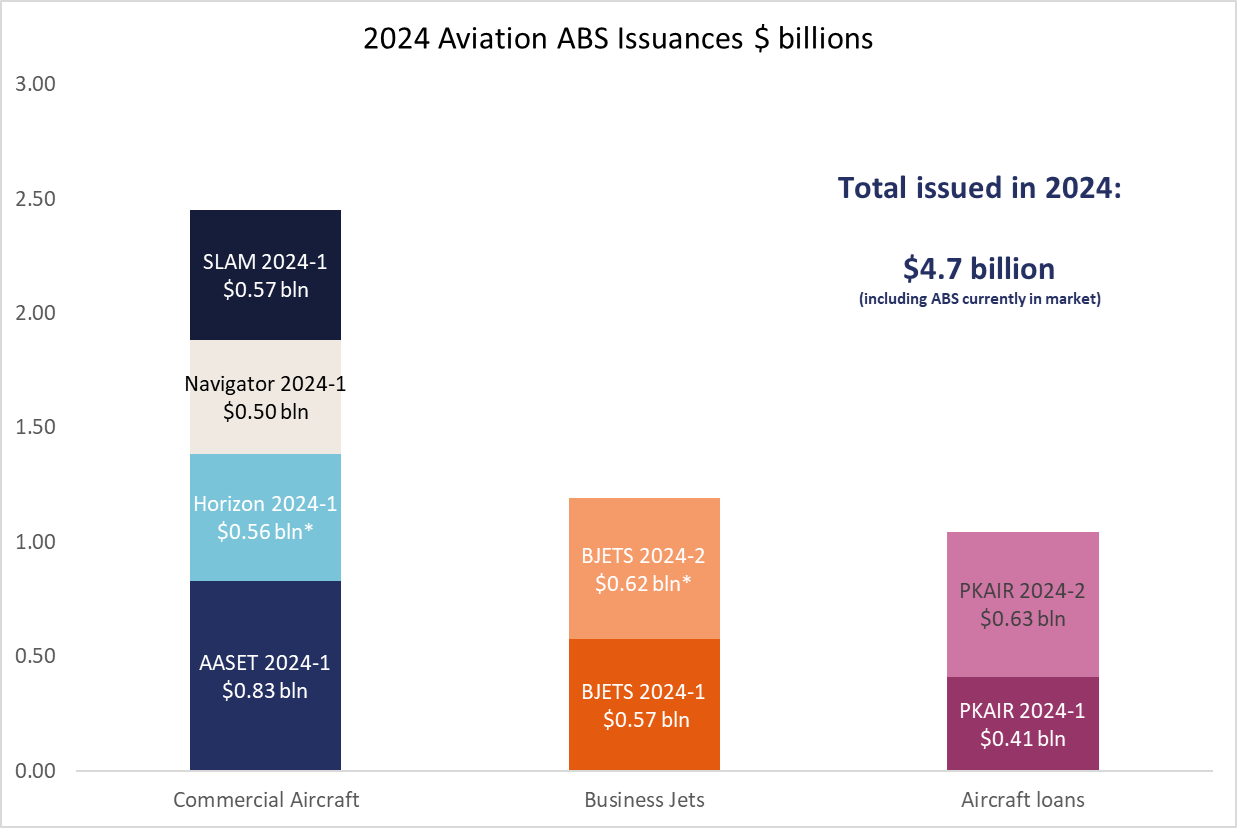

September saw a flurry of activity as three aircraft lease securitisations and one aircraft loan ABS came to market. The timing was intentional explains one source, who states investment banks would have likely advised ABS sponsors to come to market before the Fed made its announcement to lower the target rate by half a percentage point to 4.75% to 5%. All of the deals eventually achieved yields below 5.5% (see Insight). “Investors were expecting a cut in rates, but if issuers had delayed, and there hadn’t been a cut, it could have killed the deal,” explains one source.

Lower rates and higher leases need for subordinated tranches

One consistent question over recent aircraft ABS deals has been whether the latest wave of aircraft ABS deals coming to the market would be able to issue subordinated notes. DAE Capital is the only issuer to have priced a public note among the four deals that came to market in September but Carlyle succeeded in adding an A2 and a B note to its 2024 ABS which came to market in June (see Insight).

Financiers and lessors speaking at the ISTAT conference stated that rates would likely have to fall lower before aircraft ABS issuers would be able to issue C and E notes. Speaking at the conference, Vinodh Srinivasan, an MD at Mizuho, told attendees “I think if you could start seeing costs coming in by another 150 to 100 basis points, and as lease rates come up, [then] there's more cash to actually service the subordinated notes. That has to happen before you start seeing those transactions. But we've been in the market with e-note transactions and other asset classes outside of aviation, and there's a strong bid for it. So, it's about getting the math to work.”

A generally better funding environment

The capital markets and commercial debt markets have been becoming more favourable to borrowers over the last six to nine months, helped by rate stabilisation and the widespread expectation of a rate cut, which has now finally come to pass. This has helped aircraft ABS issuers.

Greg Willis, ALC’s CFO, speaking on the same panel agreed that spreads had fallen. “I think we're starting to see base rates come down. Spreads have been at their near tightest in a long time. So, it's created a pretty good funding environment right now. I think if you were to go out there and do deals right now, there's a lot of positive investors that want to put money to work.”

But he added that there were concerns about a potential rate cut leading to a recession. “Obviously, we're all worried about a potential recession, and so when you have a yield curve inversion for a long time, when the Fed starts cutting rates, it kind of leads to that. I mean you're trying to avoid a recession, but we are all hoping for a soft landing, which hopefully will be good for spreads.”

A combination of global events and economic factors over recent years has strengthened the aviation finance market, including strengthening lease rates, and has led to an arguably quicker-than-expected resurgence of aviation ABS. Trish O'Donnell, a partner at Reed Smith, notes that there are still concerns over structuring —specifically related to LTV ratios and persistently high interest rates. “To address these concerns, the most recent commercial aircraft ABS issued, and in the market, have been structurally more robust from those issued pre-Covid. These transactions are largely single tranche, with the vast majority of aircraft being younger, with longer amortization profiles, lower LTVs, larger security deposits and liquidity facilities, together with more common structural enhancements, such as DSCR tests with rapid amortisation if breached and cash traps,” explains O'Donnell.

The Ishka View

2024 has the makings for a potentially very good year for public aircraft ABS, in terms of total amount issued, but it is unlikely to be even close to a record year given the limited number of B notes issued so far. Ishka hears that several potential ABS issuers have portfolios coming to market, but it not clear when.

Some sources are bullish that some of these deals could come to market before thanksgiving 2024, but Ishka hears that some lessors are debating about whether to come to market in six months’ time, possibly after the Fed announces further cuts, which could help aircraft ABS sponsors issue more subordinated notes.

Sign in to post a comment. If you don't have an account register here.